Are you looking for an Artificial Intelligence for Trading Udacity Review? If yes, first read my Artificial Intelligence for Trading Udacity Review and then decide whether to enroll in this Nanodegree program or not.

Artificial Intelligence for Trading Udacity Review/ AI for Trading Review

My Personal Experience: Artificial Intelligence for Trading Udacity

| Point | Description |

|---|---|

| Course Overview | I recently completed the “Artificial Intelligence for Trading” Nanodegree Program by Udacity. This program focused on applying AI in financial trading and covered a range of topics including trading strategies, quantitative analysis, and machine learning specific to the financial markets. |

| Positives | In my experience with the Artificial Intelligence for Trading Nanodegree program, I found several positive aspects. Firstly, I found ✅ The curriculum is to be comprehensive, covering essential topics such as quantitative trading, machine learning, and portfolio optimization. ✅ I appreciated the practical project experience that the program provided. It allowed me to apply my knowledge to real-world trading problems, which was both engaging and rewarding. ✅ Additionally, I found the program’s industry relevance to be a significant benefit. Udacity collaborated with industry experts to develop the content, ensuring that it remained up-to-date with the latest trends and practices in the field. |

| Negatives | However, I also encountered some challenges during my journey. ❌ One notable aspect was the higher cost of enrollment compared to other online learning platforms. This is something to consider, especially for individuals with limited financial resources. ❌ Additionally, I found that the level of interaction with instructors and peers was somewhat limited. While support was available through the community and mentor network, the depth of feedback and collaboration opportunities was not as extensive as in a traditional classroom setting. |

| Course Structure and Format | The Nanodegree program was structured in a self-paced format, allowing me to learn at my own convenience. It consisted of video lectures, quizzes, and hands-on projects that provided practical experience. |

| Instructor and Teaching Style | The instructors were highly knowledgeable and experienced in the field of AI for trading. However, the teaching style primarily relied on video lectures, which could have been complemented with more interactive or practical engagement for a richer learning experience. |

| Learning Experience | My learning experience throughout the Nanodegree program was enriching. Having a solid foundation in finance and programming allowed me to grasp the concepts effectively. However, I can imagine that beginners might find the course challenging without additional self-study or external resources to supplement their understanding. |

| Course Difficulty | The Nanodegree program covered intermediate to advanced concepts in AI and trading. It was suitable for learners with some background knowledge in finance and programming. |

| Course Resources | Additional resources such as readings and references were provided alongside the core curriculum. While these resources were helpful, I occasionally found them lacking in-depth explanations. |

| Projects | The Nanodegree program included projects that required applying the learned concepts to real-world trading scenarios. These practical tasks provided hands-on experience and allowed me to develop my skills in designing and implementing trading strategies using AI techniques. However, I felt that the instructions and feedback for these assignments could have been more detailed and provided clearer guidance. |

| Community and Interaction | The program offered a discussion forum for learners to interact and engage with peers. While the community was supportive, the level of engagement and instructor participation varied. A more active community and increased support from instructors would have further enhanced the learning experience. |

| Course Support | Udacity provided support throughout the program; however, there were instances where I experienced delays in receiving assistance or responses to my inquiries. Although a help center and support channels were available, improvements could be made to ensure more timely and reliable support for learners. |

| Overall Impression | Overall, I am pleased with the “Artificial Intelligence for Trading” Nanodegree program. It provided a comprehensive introduction to AI in financial trading, covering relevant topics and offering valuable insights. However, there were limitations in terms of engagement, support, and clarity. To optimize the learning experience, I recommend supplementing the program with additional resources and self-study. |

Now, let’s start the Detailed Review

Detailed Review

Note-> In this review, I tried to cover each and every lesson that I learned in the Nanodegree Program. I know this review is too long to read but it is worth knowing the Nanodegree closely before enrolling.

I would suggest you read the complete Udacity Artificial Intelligence for Trading Nanodegree Review and understand whether the content and projects covered in the Nanodegree Program are beneficial for you or not.

- My Personal Experience: Artificial Intelligence for Trading Udacity

- Detailed Review

- How I Enrolled in Udacity Artificial Intelligence for Trading?

- How were the Content and Projects of Udacity Artificial Intelligence for Trading Nanodegree/ AI for Trading?

- Unique Features of Udacity

- Udacity Features Which I Didn't Like

- How Much Time and Money Do You Have to Spend in Udacity Artificial Intelligence for Trading Nanodegree/ AI for Trading?

- How to Get a Discount on Udacity Artificial Intelligence for Trading Nanodegree?

- How were the Instructors?

- Is Udacity Artificial Intelligence for Trading Nanodegree Worth It?/ Is AI for Trading Nanodegree Worth It?

- Final Thought

- Conclusion

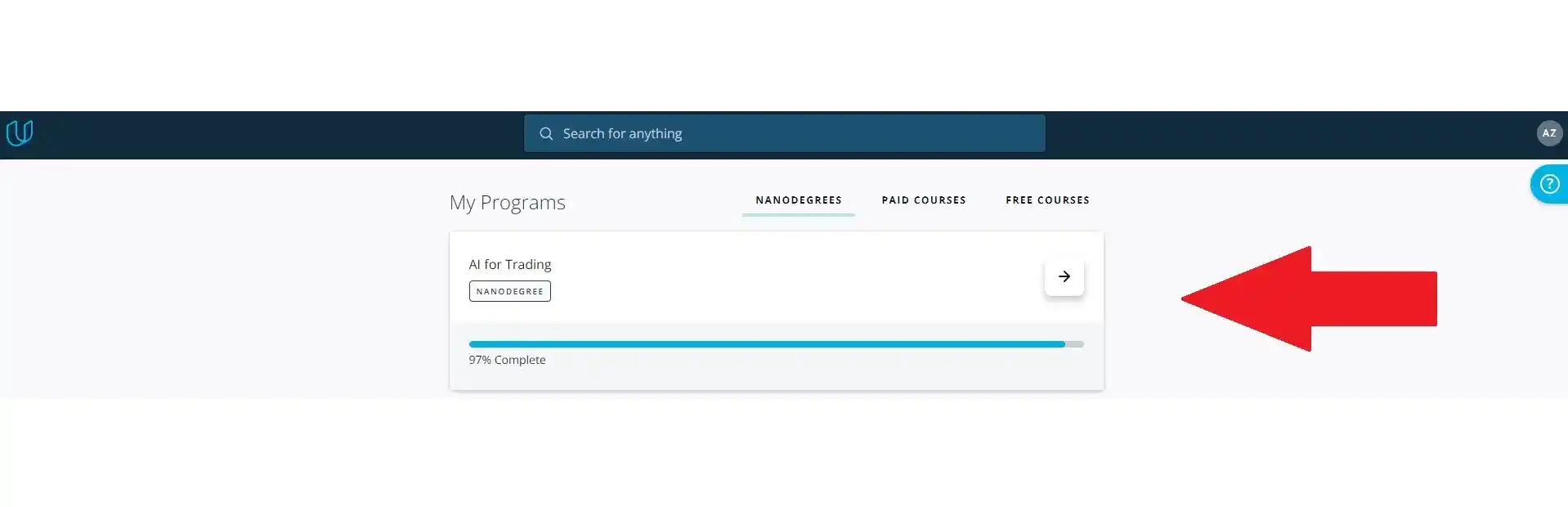

How I Enrolled in Udacity Artificial Intelligence for Trading?

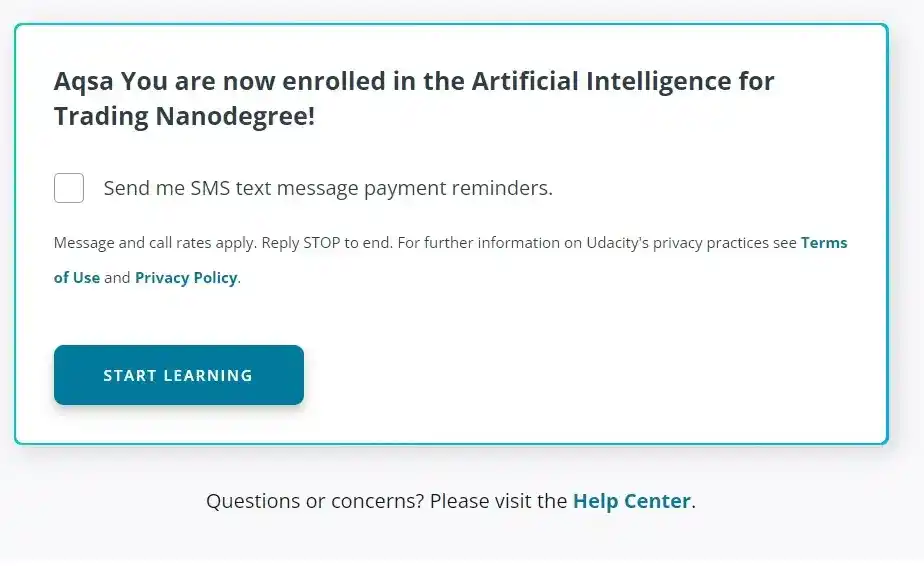

So, let’s begin this review from scratch. Once I enrolled in the program, this window appeared-

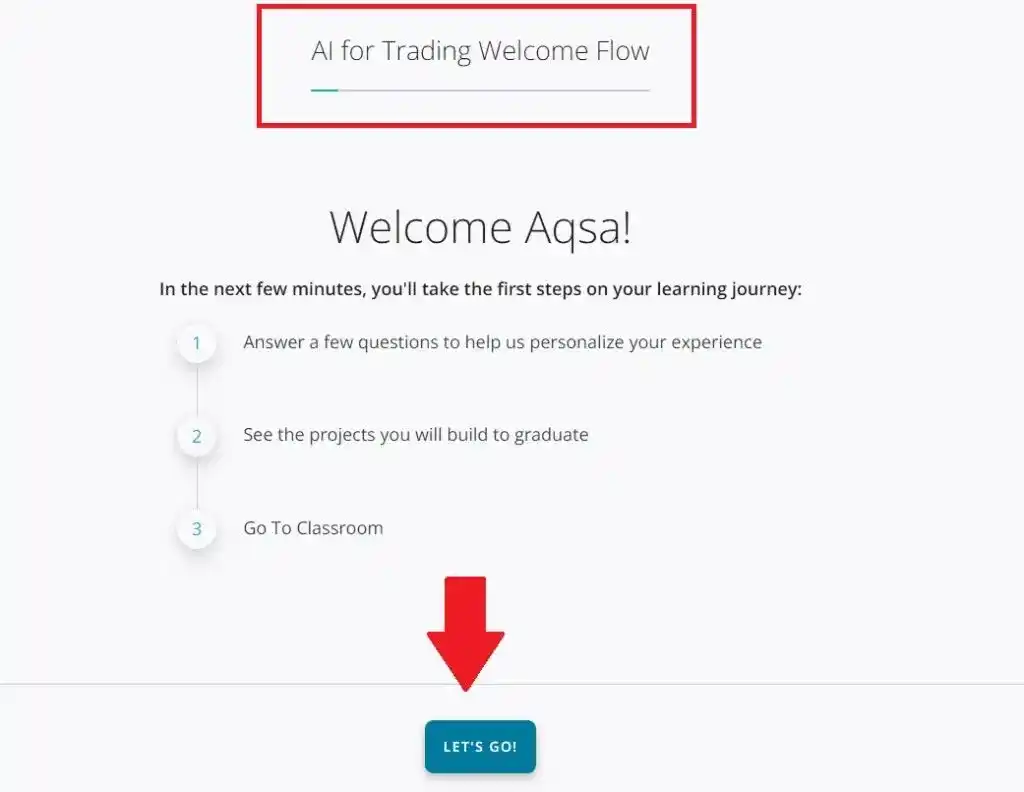

I clicked on the “Start Learning” button and I was redirected to the welcome screen of the Nanodegree Program. Which was something like that-

I clicked on the “Let’s Go” button and on the next page, some unique features of Udacity were listed such as Technical Mentors, Career Services, etc. I will discuss these features later in this article.

In the next few pages, Udacity asked some questions such as–

- What is your primary motivation for enrolling in this Udacity program?

- How do you intend to study for your Udacity program?

- Do you prefer to learn on your own or with others?

- Have you taken any online learning before starting your Udacity program? etc.

Once I answered all these questions, I was all set to begin my Nanodegree Program. Now, let’s start this Artificial Intelligence for Trading Udacity Review and see how was the Course Content and Projects of Udacity AI for the Trading Nanodegree Program.

How were the Content and Projects of Udacity Artificial Intelligence for Trading Nanodegree/ AI for Trading?

Udacity Artificial Intelligence for Trading Nanodegree was divided into two sections-

- Quantitative Trading

- AI Algorithms in Trading

Quantitative Trading is known as Term 1, where there were 4 projects and 4 modules. AI Algorithms in Trading is known as Term 2, and Term 2 had 4 projects and 4 modules.

Now, let’s see what was covered in each section.

Term 1- Quantitative Trading

The first lesson was Introduction to the Nanodegree Program. In this first lesson, I got to know about this Nanodegree Program such as the structure of the Nanodegree Program, who are the instructors of Nanodegree Program, what kind of support Udacity provides, etc.

Along with that, I learned about Quants from the lead Instructor, Jonathan Larkin, and got insights from a Quant. He explained that a “Quant is someone who is good at using Technology, math, and statistics to solve business problems.”

The first lesson was very informative and my half doubts were cleared regarding the Nanodegree structure and study plan.

The next lesson was common in every Nanodegree Program, where they explained Udacity Support features and what kind of help I receive during the Nanodegree Program. I will discuss Udacity Support later in this review.

Lesson- Stock Prices

So, the first lesson from where the learning began was “Stock Prices”. In this lesson, the instructor explained stocks and stock prices. I also got to know different terminology of stocks such as Common Stock, Preferred Stock, Dividend, Capital Gains, Debt Security, etc.

In this lesson, there was one quiz on bringing stock prices into Pandas.

Lesson- Market Mechanics

In this lesson, I learned about market mechanics and the mechanics behind modern-day markets. I also understood the Farmer’s market and how they choose the price for selling any item. They gave us an example of the Orange market.

This lesson also covered concepts of Trading Stocks, Liquidity, OHLC: (Open, High, Low, Close), Gaps in Market Data, and Markets in Different Timezones.

There was one quiz in this lesson, where I had to resample the data.

Lesson- Data Processing

In the next lesson, the instructor explained Data Processing and how the quality of data matters for prediction. They used market data for explaining when to use Time Stamps. This lesson is combined with video lectures and text tutorials. Along with that, there was a quiz on Trading Experiment.

There was an interview with Deven Desai, a product lead at Planet. He shared a bit about data that can be gathered by satellites and how this data may be applied in finance. This lesson was very insightful.

Lesson- Stock Returns

This is a short lesson where I learned about Stock Returns, Log Returns, and Distributions of Returns and Prices. This lesson covered some mathematical formulas of Return and Log Return. This lesson also had one quiz on calculating Returns. This lesson requires previous math knowledge.

Lesson- Momentum Trading

This was not an easy lesson for me because this lesson covered lots of technical terms such as how to design a Trading Strategy, Momentum-based Signals, Long and Short Positions, Statistical Analysis, Finding Alpha, etc.

If you don’t have previous statistical knowledge, you will not understand any concepts. That’s why I would suggest you first learn statistics before enrolling in this Nanodegree program. This lesson has 6 quizzes. I took a long time to complete this lesson.

After this lesson, there was the first project of this Nanodegree Program.

Project 1- Trading with Momentum

In this first project, I had to implement a momentum trading strategy and perform a statistical test to check whether there is alpha in the signal or not.

This was not a tough project. Udacity provided a textual description of how to generate a trading signal based on a momentum indicator.

Udacity also provided a Trading with Momentum Workspace and I had to submit the project from the workspace.

The best thing I found in Udacity was its Technical Mentor Support. Throughout the project, I asked them about my doubts to mentor and he helped me with this project.

Check Current Discount at-> Udacity Artificial Intelligence for Trading Nanodegree

After this project, a new module began and this module had a set of lessons.

Lesson- Quant Workflow

This was a quick lesson on Quant Workflow. In this lesson, I learned about good Hypotheses and how to do market research. The instructor of this lesson also explained Quant Workflow, Flavors of Trading, and Anatomy of a Strategy.

She explained three types of Anatomy of a Strategy. Overall, this is a complete theoretical lesson. There was no quiz in this lesson.

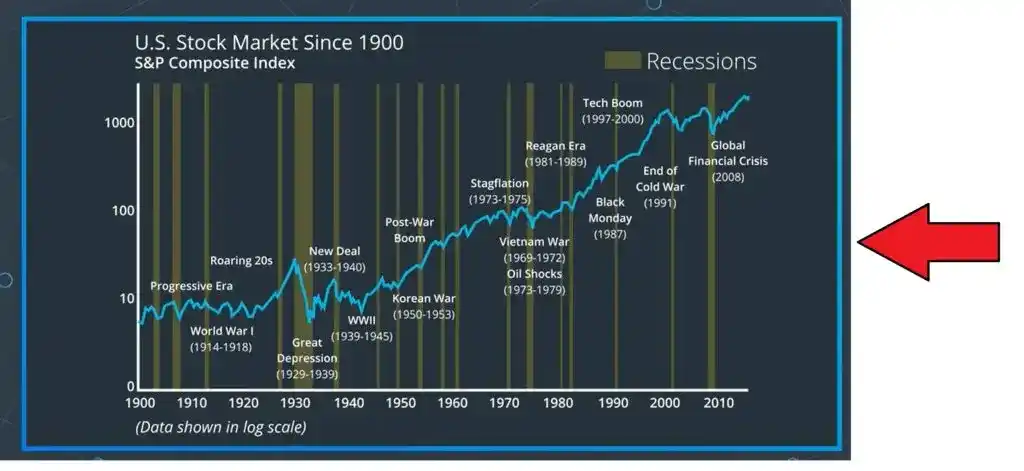

Lesson- Outliers and Filtering

This lesson covered Outliers, Sources of Outliers, how to handle Outliers, and how to generate Robust Trading Signals. In this lesson, I got to know how outliers can damage prediction results.

The instructor also showed some insightful data on the US Stock Market.

Lesson- Regression

This was a practical lesson. This lesson had lots of practical exercises and quizzes. In this lesson, I learned about Distributions, Parameters of Distribution, Testing for Normality, Heteroskedasticity, Linear Regression, Multivariate Linear Regression, and Regression in Trading.

This lesson requires previous statistical knowledge. In this lesson, you need to remember various stats formulas. I would recommend you take notes of these formulas for future reference.

Lesson- Time Series Modeling

This was a short lesson on Time Series Modeling but covered lots of essential concepts such as Autoregressive Models, Advanced Time Series Models, Kalman Filter, Particle Filter, and Recurrent Neural Networks.

The instructor taught two statistical methods in this lesson- Autoregression and Moving Average. I liked their visual explanation of the concepts. I know, these concepts are not easy to understand but the instructors of this Nanodegree tried to explain all these concepts visually. Which was very helpful.

Lesson- Volatility

Volatility is an important measure of risk. And Risk is nothing but uncertainty about the future related to finance. This lesson covered Historical Volatility, Annualized Volatility, Forecasting Volatility, and Scale of Volatility.

The instructor also explained Breakout Strategies and how to use volatility for equity trading. There is one quiz in this lesson to estimate Volatility.

Lesson- Pairs Trading and Mean Reversion

This lesson was not easy to digest lesson because this lesson covered some technical terms. If you are not from the finance domain like me then you have to watch this lesson two times. All the concepts covered in this lesson were new to me.

The instructor covered Mean Reversion, Pairs Trading, Finding Pairs to Trade, Cointegration, ADF and roots, Trade Pairs of Stocks, etc.

This lesson also had quizzes and exercises. Lots of formulas and technical concepts were discussed in this lesson. But thanks to their visual representation. It helped me a lot to understand these concepts.

After this lesson, there was the next project of this Nanodegree Program.

Project 2- Breakout Strategy

In this project, I had to implement what I learned in the previous lessons such as I had to implement the breakout strategy, finding and removing any outliers, and testing to see if it has the potential to be profitable using a Histogram and P-Value.

Udacity provided a Breakout Strategy Workspace. Where I had to complete and submit the project.

To complete this project, previous knowledge of Pandas and Numpy is required.

Check Current Discount at-> Udacity Artificial Intelligence for Trading Nanodegree

Lesson- Stocks, Indices, Funds

In this lesson, I learned about Stocks, Indices, and Funds. This was a complete theoretical lesson where the instructor explained the concept of Market Cap, Growth V. Value, Ratios, Index Categories, Price Weighting, Market Cap Weighting, Hang Seng Index Construction, etc.

I also learned about Funds, Mutual Funds, Hedge Funds, Hedging Strategies, Open End Mutual Funds, and Close End Mutual Funds.

This lesson had one quiz on Rate of Returns Over Multiple Periods using Numpy.

Lesson- ETFs

This was again a theoretical lesson on ETF(Exchange Traded Funds). In this lesson, the instructor taught How ETFs are Used, ETF Sponsors, Authorized participants and the Create Process, Redeeming Shares, Lower Operational Costs & Taxes, Arbitrage, and Arbitrage for Efficient ETF Pricing.

All these terms were new to me because my background is not in finance. But I liked how the instructor explained these concepts.

Lesson- Portfolio Risk and Return

This lesson explained how to distribute money to not only maximize the return but also minimize the risk. I learned about the Diversification concept.

After that, I learned Portfolio Mean, Portfolio Variance, Variance of a 3-Asset Portfolio, The Covariance Matrix and Quadratic Forms, Calculate a Covariance Matrix, Capital Market Line, and The Sharpe Ratio.

My Advice-> To understand these technical terms, don’t rush to complete these lessons. Take your time and learn according to your pace, especially if you are not from the finance domain.

This lesson covered essential technical concepts of stock risk and returns. This lesson also had two quizzes.

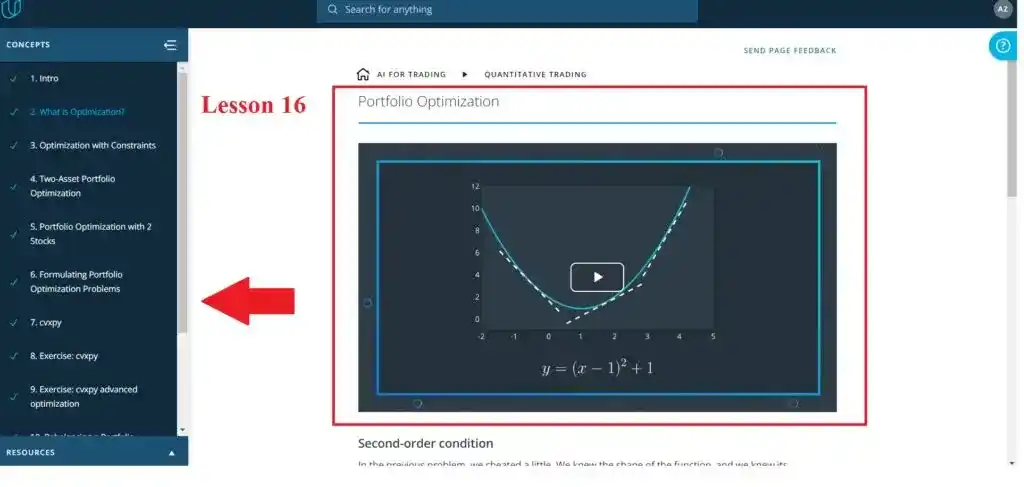

Lesson- Portfolio Optimization

This lesson was focused on teaching the strategies for optimizing the return on your portfolio. In this lesson, I learned what is Portfolio Optimization, Optimization with Constraints, Two-Asset Portfolio Optimization, Portfolio Optimization with 2 Stocks, Formulating Portfolio Optimization Problems, Rebalancing a Portfolio, and Rebalancing Strategies.

This lesson also had some text base tutorials and exercises on Portfolio Optimization using cvxpy. There were some mathematical concepts discussed in this lesson. Previous math knowledge is essential to understand these complex concepts.

After this lesson, there was a third project of this AI for Trading Nanodegree.

Project 3- Smart Beta and Portfolio Optimization

This project had two parts that mean in the first part, I had to build a smart beta portfolio. After that, I had to calculate the tracking error.

In the next part, I had to rebalance the portfolio using quadratic programming and calculate the turnover to check the performance.

This project helped me to practice the math of portfolio optimization learned in previous lessons.

Udacity provided a Smart Beta and Portfolio Optimization Workspace where Pandas and Numpy packages were already imported.

This was not an easy project for me. Because there was math used in this project.

But the mentor helped me by telling me my mistakes and suggested where to improve by showing the improved code.

Check Current Discount at-> Udacity Artificial Intelligence for Trading Nanodegree

Lesson- Factors

This was the last module of the first section “Quantitative Trading“. And this was the first lesson of this module. In this lesson, I learned factors- Alpha factors and Risk factors. Alpha factors are drivers of mean returns and Risk factors are drivers of volatility.

I learned how to create, improve factors, and fit them into a model. The instructor also explained Examples of a factor, Standardizing a factor, De-mean, Rescale, Overview for standardizing a factor, and Zipline Pipeline.

This lesson had quizzes and exercises on factor values and weights, dollar neutral and leverage ratio, and Zipline Coding Exercises.

Lesson- Factor Models and Types of Factors

This was a detailed lesson and covered various essential concepts such as Factor Model, Factor Model Assumptions, Covariance Matrix Using a Factor Model, Factor Models in Quant Finance, Risk Factors v. Alpha Factors, Momentum or Reversal, Price-Volume Factors, Fundamental Ratios, Event-Driven Factors, Index Changes, Analyst Ratings, etc.

This lesson also covered Sentiment Analysis on News and Social Media and how NLP is used to enhance Fundamental Analysis.

This lesson was one hour long. But it took more than an hour to finish this lesson. Because the concepts discussed in this lesson were not easy for me.

Things started interesting for me when the instructor explained about NLP and sentiment analysis because I knew these concepts.

Lesson- Risk Factor Models

This was a practical lesson where the instructor explained to install python libraries for all code exercises in this lesson. In this lesson, first, I learned the Factor Model of Asset Return, Factor Model of Portfolio Return, Variance of one stock and two stocks, Covariance Matrix of Assets Exercise, and Types of Risk Models.

After explaining each concept, there was one exercise on the topic. That’s why this lesson took more than two hours to complete.

Lesson- Time Series and Cross-Sectional Risk Models

This lesson covered Time Series Model and explained Factor Variance, Factor Exposure, specific variance, and the Time Series Risk Model.

Fama French Risk Model and Cross-Sectional Model were also explained in this lesson. The method of explaining these concepts was good and easy to understand. That’s why I got these concepts otherwise they are very complex topics.

The instructor explained Cross Sectional approach too.

Lesson- Risk Factor Models with PCA

This lesson was interesting for me because it covered PCA(Principal Component Analysis) and machine learning concepts. But to understand the PCA, math and linear algebra concept is required. And that’s why the instructor explained vectors and provided a link to the Essence of linear algebra Youtube tutorial series link.

This lesson covered PCA Toy Problem, PCA as a Factor Model, and various PCA exercises.

Lesson- Alpha Factors

This was the lengthiest lesson in this module. It took more than 3 hours to complete this lesson when you easily understand the concepts otherwise It might take more time.

I thought that Udacity need to divide this lesson into two lessons. Because covering that much content in one lesson might confuse and irritate the students.

The whole lesson had lots of quizzes on the topics covered such as sector Neutral Exercise, Ranking exercise, z-score quiz, Smoothing Quiz, Factor returns quiz, Turnover Exercise, etc.

Due to lots of practical exercises, this lesson forced me to think and understand the concepts. Because without understanding the topic, it’s hard to do quizzes and exercises.

Lesson- Alpha Factor Research Methods

This lesson focused on four academic papers to see how to code up Alpha factors from them. Honestly speaking this was a boring lesson for me. You might feel interested if you like theory. It totally depends upon you. But I didn’t enjoy this lesson. The whole lesson was based on academic research papers and the instructor explained these papers.

Lesson- Advanced Portfolio Optimization

This was the last lesson of this section “Quantitative Trading” and of this module. In this lesson, I learned how to set up a portfolio optimization problem using alpha factors and risk models.

The instructor also explained Regularization, Standard Constraints, Leverage Constraints, Factor Exposure, Position Constraints, Estimation Error, Transaction Costs, and Path Dependency.

This lesson also had an exercise where I had to construct an optimization problem using a stock universe consisting of 3 stocks.

After this lesson, there was a fourth and last project in this “Quantitative Trading” section.

Project 4- Alpha Research and Factor Modeling

In this project, I had to use the concepts learned in the previous lesson and build a statistical risk model using PCA.

I had to build a portfolio along with 5 alpha factors. And then I had to check the performance of these 5 alpha factors with respect to factor-weighted returns, quantile analysis, Sharpe ratio, and turnover analysis.

At the end of this project, I had to optimize the portfolio by using the risk model and factors using multiple optimization formulations.

And here, Term 1 or Section 1 “Quantitative Trading” end.

Summary of Term 1

->If you ask me how was the content of term 1, I would say that term 1 was loaded with advanced and basic concepts of Quantitative Trading.

->It was a fun and challenging journey with term 1. My domain is computer science and I didn’t learn any such concepts in past, that’s why understanding these concepts was a little bit tough for me. But thanks to the Nanodegree Instructors who explained the concepts visually that method helped me to catch the concept.

->Term 1 required previous math knowledge, especially in statistics, linear algebra, and calculus. Without having math knowledge, I would not suggest starting this Nanodegree.

->Overall, I learned various new and interesting concepts in Term 1 related to finance and trading. These concepts will help me in the future.

Check Current Discount at-> Udacity Artificial Intelligence for Trading Nanodegree

After Term 1, the exciting part began for me which was Term 2-> AI Algorithms in Trading. Let’s see what I learned in Term 2 and how was the content.

Term 2- AI Algorithms in Trading

This was the first lesson of term 2, where the instructors explained what they will teach in this term. Along with that, there were two interviews added. One is an Interview with Gordon Ritter. Gordon Ritter is the Professor and portfolio manager. Another Interview was with Justin Sheetz. Justin Sheetz is an investment strategist and quant research analyst. They explained their experience in the field.

Lesson- Intro to Natural Language Processing

This was an intro lesson to NLP(Natural Language Processing). This was a fun lesson where I learned Structured Languages, Grammar, Unstructured Text, NLP Pipelines, and How NLP Pipelines Work.

I also learned Text Processing, Feature Extraction, and Modeling. This was a complete theoretical lesson but I enjoyed this lesson. I liked how the instructor explained each concept visually. For eg., he explained text processing with the help of a Wikipedia example. And I understood the text processing basic mechanism.

Lesson- Text Processing

This was a more detailed lesson on text processing. I already knew the concepts, and that’s why I completed this lesson fast. In this lesson, I learned the steps involved in text processing such as Normalization, Tokenization, Cleaning, Stop Word Removal, Part-of-Speech Tagging, Named Entity Recognition, Stemming, and Lemmatization.

This lesson helped me to revise these concepts. There was one exercise in this lesson on processing tweets. Text Processing Coding Example was also present in this lesson.

Lesson- Feature Extraction

This was a short lesson on Feature Extraction. After cleaning the text, we need to transform the text into features. And these features are used for modeling. In this lesson, the instructor explained the concept of Bag of Words and TF-IDF.

One-Hot Encoding is one way of representing words and this term was explained in this lesson. Some other interesting concepts such as Word Embeddings, Word2Vec, and GloVe are also covered in this lesson.

Lesson- Financial Statements

This was a detailed lesson where the instructor told us how to study financial documents closely and how to extract features that are helpful for trading. I also learned how to navigate an SEC website and how to search the EDGAR database for the desired 10-K documents.

The instructor also explained Regexes, Finding MetaCharacters, Word Boundaries, Substitutions and Flags, BeautifulSoup library, and much more.

Overall, this lesson was insightful and interesting.

Lesson- Basic NLP Analysis

This lesson covered how to convert the text in financial statements into quantitative data. I learned the three frequently used metrics for financial analysis- Readability, Sentiments, and Similarity.

This lesson also had two exercises on Readability and Bag of Words and Document Vector.

Project 5- NLP on Financial Statements

This was the first project of Term 2. In this project, I had to perform NLP Analysis on 10-k financial statements and generate an alpha factor.

This project required two corpora to run this project. The first one is the stopwords corpus for removing stopwords and the second one is the wordnet for lemmatizing.

Quotemedia and Loughran-McDonald sentiment word lists are used as a dataset. This was a challenging as well as a fun project.

Check Current Discount at-> Udacity Artificial Intelligence for Trading Nanodegree

After this project, the next module started with these lessons-

Lesson- Introduction to Neural Networks

The title of this lesson is “Introduction to Neural Networks” but this lesson was more than the intro. This lesson covered deep learning and neural network concepts in detail. Some interesting concepts I learned in this lesson for eg. Perceptron Trick, Non-Linear Regions, Log-loss Error Function, Maximum Likelihood, Cross-Entropy, Logistic Regression, Gradient Descent, Backpropagation, etc.

I liked their visual explanation. The complex concepts are easily explained. For eg., the instructor explained the error function by using this visual representation.

Lesson- Training Neural Networks

In this lesson, I learned the ways to optimize the training model. The instructor explained why testing is required for optimizing the model. He also explained the Overfitting and Underfitting problem.

Some other essential concepts are covered in this lesson such as Regularization, Dropout, Local Minima, Vanishing Gradient, Batch vs Stochastic Gradient Descent, Momentum, etc.

This lesson didn’t have any exercises or quizzes. This was a theoretical lesson.

Lesson- Deep Learning with PyTorch

This was a complete practical lesson where I learned how to implement Deep Learning using PyTorch. There were separate resources provided for learning PyTorch.

The instructor taught me how to build Single layer neural networks and Multilayer Networks using PyTorch. I also learned how to implement Softmax Solution, how to train a Network Solution, how to classify Fashion-MNIST, how to load Image Data, Pre-Notebook with GPU, and Transfer Learning.

The whole lesson was combined with practical exercises and solutions. But this lesson requires previous Python programming knowledge.

Lesson- Recurrent Neural Networks

This was my favorite lesson. In this lesson, I learned the most popular and trending concept “Recurrent Neural Networks“. The lesson covered what is RNN, what is LSTM, RNN vs LSTM, how to implement RNN using PyTorch, Time-Series Prediction, Character-wise RNNs, etc.

Overall, this lesson was interesting and the explanation of this lesson was easy to understand.

Lesson- Embeddings & Word2Vec

This lesson had a perfect balance between theory and practice. In this lesson, I learned how to use neural networks for natural language processing. And how to use neural networks to do word embeddings.

The instructor also explained how to implement the Word2Vec model using the SkipGram architecture. And the instructor did the code in a video tutorial to explain Data & Subsampling, Context Word Targets, Batching Data, Solution, Word2Vec Model, and Negative Sampling.

After teaching these concepts, there was one exercise on negative sampling.

Lesson- Sentiment Prediction RNN

This was also a practical lesson on RNN. In this lesson, I learned how to perform sentiment analysis. The instructor explained all the steps required in sentiment analysis such as Data Pre-Processing, Encoding Words, Getting Rid of Zero-Length, Cleaning & Padding Data, Training the Model, and Testing the model.

This lesson helped me to understand the complete procedure of building a model. In this lesson, I learned how to train a model and predict a function.

This model can predict whether the text has a positive or negative sentiment.

After learning these concepts, there was one project.

Project 6- Sentiment Analysis with Neural Networks

In this project, I had to use the concepts learned in the previous lessons. For this project, I had to build my own deep learning model that can predict if any particular message is positive or negative.

The messages I had to use were from StockTwits, a social network for investors and traders.

I had to use a five-point scale for capturing a sentiment: very negative, negative, neutral, positive, and very positive.

Check Current Discount at-> Udacity Artificial Intelligence for Trading Nanodegree

After this project, the new module started with these lessons-

Lesson- Overview

This was a short lesson on a new module. This lesson covered the types of Machine Learning algorithms such as Supervised Learning, Unsupervised, and Reinforcement Learning. And that’s all. Nothing else was covered in this lesson.

Lesson- Decision Trees

This was a detailed lesson on Decision Trees. The instructor explained the Decision Trees concept by playing an Akinator game. The explanation was fun. I never learned Decision Trees in such a way.

I also learned Tree Anatomy, Entropy, Multiclass Entropy, how to maximize Information Gain, Gini Impurity, Decision Trees in Sklearn, Titanic Survival Model with Decision Trees, etc.

This lesson was fun when the instructor explained the concepts but became challenging when there were some complex terms such as Gini Impurity.

Lesson- Model Testing and Evaluation

This lesson covered the measurement tools or you can say the model testing and evaluation techniques. The instructor explained how to test the model and covered the Confusion Matrix, Accuracy, False Negatives and Positives, Precision and Recall, Types of Errors, Cross Validation, K-Fold Cross Validation, and Validation for Financial Data.

This lesson had video tutorials as well as text tutorials. After completing this lesson, I got to know how to evaluate the model.

Lesson- Random Forests

In this lesson, I learned Random Forest Algorithm. The lesson began with Ensemble Methods and the problem with the Decision Tree Algorithm. After that, the instructor explained the concept of the Random Forest Algorithm, The Out-of-Bag Estimate, Random Forest Hyperparameters, and Random Forests for Alpha Combination.

This lesson also had one exercise where I had to train a Random Forest classifier to predict whether or not a text message is “spam”.

Lesson- Feature Engineering

This lesson covered the feature engineering and labeling concept. This was a short lesson where I learned Universal Quant Features, Market Dispersion, Market Volatility, Sector, Date Parts, and Targets (Labels).

There was one exercise on feature engineering where I had to use the price-volume data and generate features that we can feed into a mode.

Lesson- Overlapping Labels

This was another short course to learn the problem of Overlapping Labels. I learned about the particular problem with the labels that applications of machine learning to finance frequently encounter. There was also one short exercise in this lesson.

Lesson- Feature Importance

This lesson covered the Feature Importance in Finance, Feature Importance in Scikit-learn, When Feature Importance is Inconsistent, and Shapley Additive Explanations.

This lesson had theoretical explanations and practical explanations. There was one exercise on Sklearn and one exercise on Shap and Rank Features.

After completing this lesson, I learned which features are important to the model’s prediction.

Project 7- Combining Signals for Enhanced Alpha

In this project, I had to use the following alpha factors:

- Momentum 1 Year Factor

- Mean Reversion 5 Day Sector Neutral Smoothed Factor

- Overnight Sentiment Smoothed Factor

The objective of this project was to combine signals on a random forest for enhanced alpha.

Check Current Discount at-> Udacity Artificial Intelligence for Trading Nanodegree

After this project, the last module of this Nanodegree started-

Lesson- Intro to Backtesting

This lesson covered how backtesting fits into the quant research process, common mistakes that lead to misleading backtests, and the best practices needed to produce a successful backtest.

This was not a long lesson. There was one exercise on overfitting. And there was one interview with Gordon he shared his experiences working with AI in finance.

Lesson- Optimization with Transaction Costs

In this lesson, I learned how to design the portfolio optimizer for a back-test. This lesson covered technical terms related to design consideration in optimization.

I also learned time offsets, holdings in dollars, scaling alpha factor, Transaction Costs, Linear Transaction cost model, Risk Factor Matrix, risk aversion parameter, etc.

This lesson also had another interview with Gordon. In that interview, he discussed some of the research that he is most well known for, applying deep reinforcement learning to trade execution.

Lesson- Attribution

This was the last lesson of this Udacity Artificial Intelligence for Trading Nanodegree. This was a short lesson where the instructor explained attribution. Attribution is a way to understand the sources and drivers of risk and return in your portfolio, by breaking down metrics of risk and returns into components.

I also learned Exposure Vector, Variance Decomposition, Performance Attribution, and Attribution Reporting, and understand Portfolio Characteristics.

After this last lesson, there was the last project of this Nanodegree Program.

Project 8- Backtesting

This was the final project of this Nanodegree Program. In this project, I had to build a fairly realistic backtester that uses the Barra data. Gordon designed this project.

This backtester performed portfolio optimization that includes transaction costs. I also used

The technical mentor support helped me too much in this project.

Summary of Term 2

->If you asked me how was the content and projects of term 2, I would say it was worth the money.

-> Term 2 was a perfect balance between theory and hands-on.

->The projects covered in Term 2 were really challenging and not easy. But these projects help my Resume.

->The content was updated and advanced.

->I liked the method of explanation of each instructor. They tried to make the complex concepts easier. And they did it so well.

->The quizzes and exercises were well-designed and helpful to revise the learned concepts.

Now, I would like to mention the extra features of Udacity which I liked-

Unique Features of Udacity

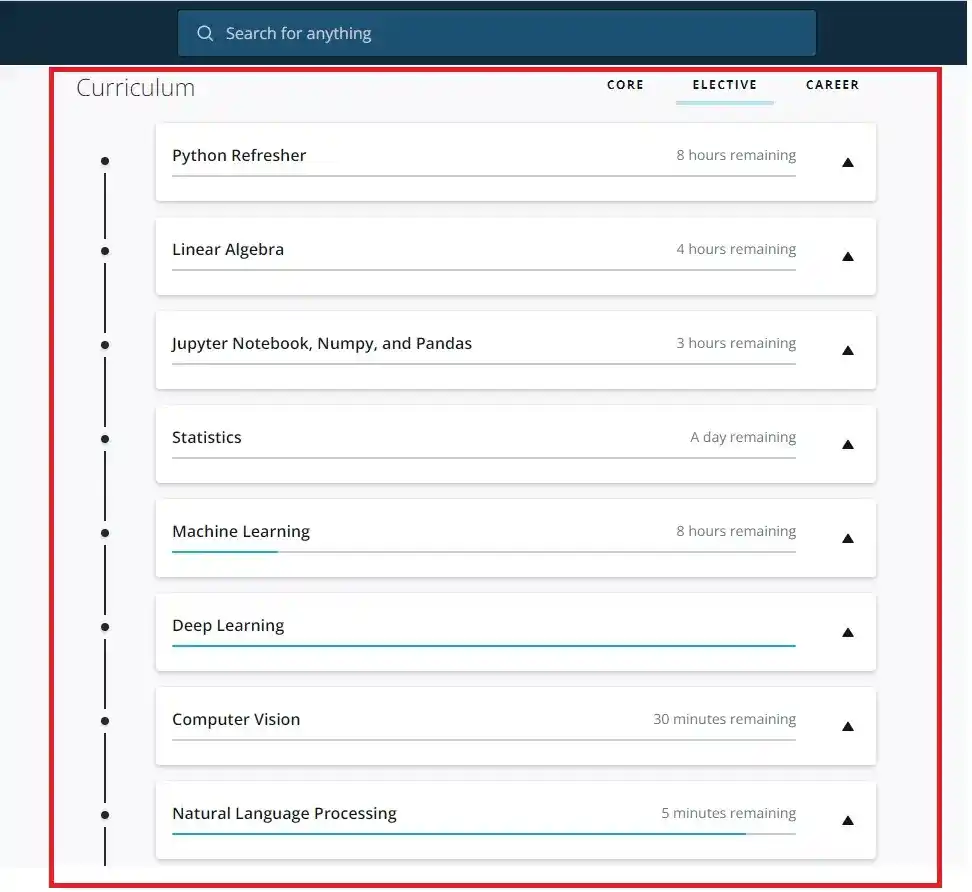

1. Elective Courses

When I enrolled in this Nanodegree program, I thought that they only provide the course content related to AI for Trading but I was amazed to see that Udacity also provides elective courses to learn the prerequisites.

Udacity Artificial Intelligence for Trading Nanodegree requires previous knowledge of Python basics, linear algebra, Jupyter Notebook basics, and statistics. And Udacity provides extra course materials for learning these topics. That means you don’t need to pay for learning these topics. These courses will cover the basics.

Check Current Discount at-> Udacity Artificial Intelligence for Trading Nanodegree

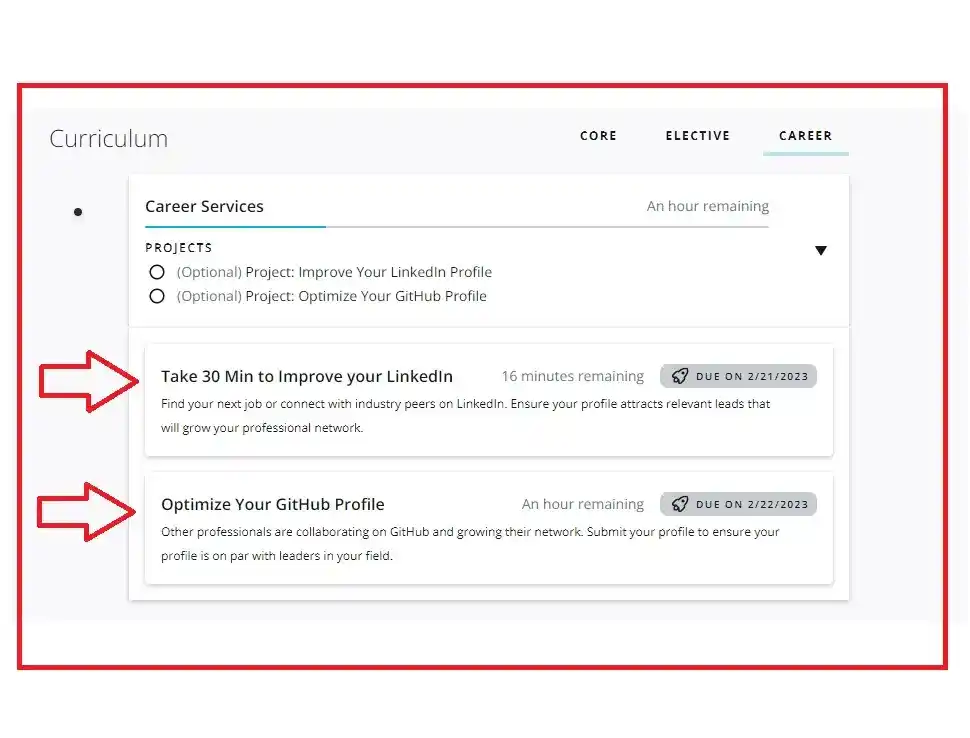

2. Career Services

Udacity also provides career services where you will get separate courses on improving your LinkedIn and GitHub profiles. This feature is unique and helps students whose LinkedIn and GitHub profile is not up to date.

3. Technical Mentor Support

I would say this feature was awesome and super helpful. I never found this feature on other platforms. Udacity’s support and community were really helpful. Whenever you are stuck and have a doubt, you can ask the mentor and he/she help you as soon as possible.

4. Live Support

Yes, Udacity also provides a “Chat Now” feature, where you can ask your other question with a chatbot. This feature helps when you are stuck with some navigation or other kind of issue.

5. Support Community

Udacity also has a support community, where you can ask your doubts to other learners. Most of the time, you can find your doubts in previously asked questions. But if your doubt is not previously asked, you can start a discussion.

So, these are the features I liked and found helpful during this Nanodegree. But everything has two sides. Some positives also have some negatives. Now, I would like to discuss what I didn’t like during the Nanodegree Program-

Udacity Features Which I Didn’t Like

1. Doesn’t have any IOS and Android apps

Most of the time, we learn on our smartphones because this is handy. But Udacity doesn’t have any mobile app for learning. I didn’t like this. Every time you have to open your PC or Laptop for this Nanodegree Program.

2. You can’t access the Course Material After Completing the Nanodegree

Yes, that’s why I would suggest taking notes while learning. Once you finish the Nanodegree program, you can’t access the course content.

So, these are two things I didn’t like in Udacity. Now, let’s talk about the pricing and duration of Udacity Artificial Intelligence for Trading Nanodegree.

How Much Time and Money Do You Have to Spend in Udacity Artificial Intelligence for Trading Nanodegree/ AI for Trading?

According to Udacity, the Udacity Artificial Intelligence for Trading Nanodegree program will take 6 months to complete if you spend 10 hours per week. And for 6 months they cost around $1563. But Udacity offers two options- One is either pay the complete amount upfront or you can pay monthly installments of $399/month.

Udacity

I know Udacity Artificial Intelligence for Trading Nanodegree is expensive as compared to other MOOCs.

But most of the time, Udacity provides discounts on its Nanodegree Program. I also enrolled in the Nanodegree Program by applying a discount coupon.

Now, let’s see how to get a discount on Udacity Artificial Intelligence for Trading Nanodegree.

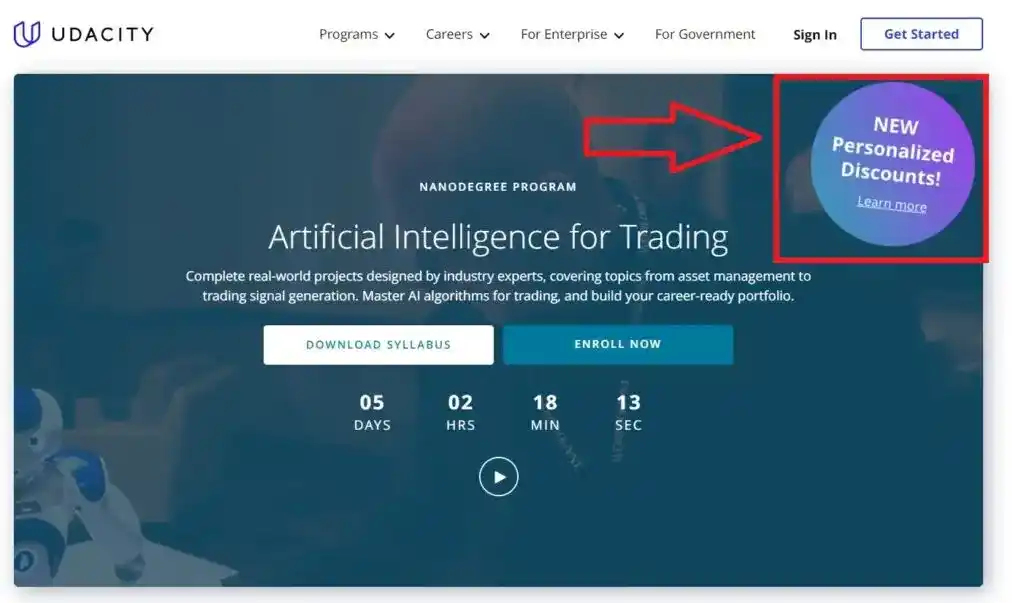

How to Get a Discount on Udacity Artificial Intelligence for Trading Nanodegree?

Udacity’s most popular discount is “Personalized Discount”. When you go to the Udacity Artificial Intelligence for Trading Nanodegree, you will see an option of “Personalized Discount”, that looks something like that-

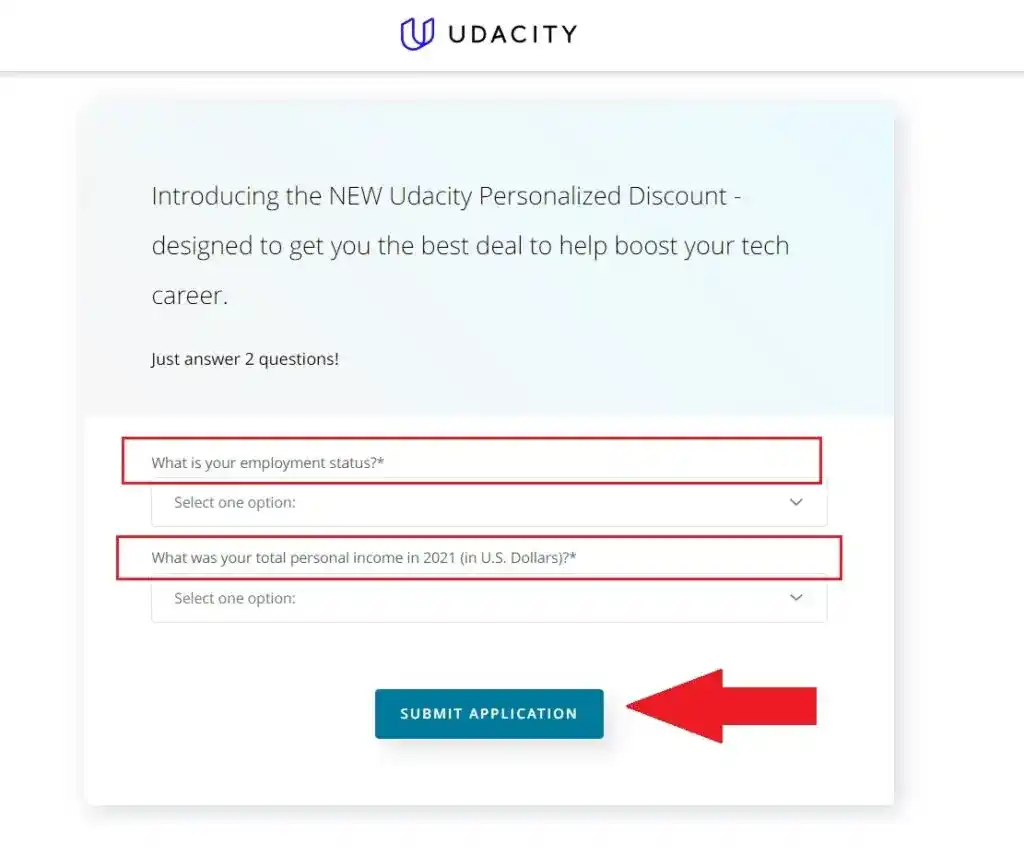

Click on “New Personalized Discount” and you will be redirected to the next page. On the next page, you have to answer the two questions from a drop-down list-

After answering these two questions, click on the “Submit Application” button and you will get a discount coupon code on AI for Trading Nanodegree Program.

You need to apply the coupon provided by Udacity at the time of checkout. And you will get a discount on the Udacity Artificial Intelligence for Trading Nanodegree. So to get a discount on Udacity, you need to wait for their sale.

You can check the current Discount of Udacity here.

How were the Instructors?

All the instructors were experienced and have knowledge in Finance and AI domains.

- Cindy Lin– Cindy is a quantitative analyst with experience working for financial institutions such as Bank of America Merrill Lynch, Morgan Stanley, and Ping An Securities.

- Arpan Chakraborty– Arpan is a computer scientist with a Ph.D. from North Carolina State University.

- Elizabeth Otto Hamel- Elizabeth received her Ph.D. in Applied Physics from Stanford University.

- Eddy Shyu– Eddy has worked at BlackRock, Thomson Reuters, and Morgan Stanley, and has an MS in Financial Engineering from HEC Lausanne.

- Brok Bucholtz– Brok has a background of over five years of software engineering experience from companies like Optimal Blue.

- Parnian Barekatain– She runs a ShannonLabs fellowship to support the next generation of independent researchers.

- Juan Delgado– He previously worked at NASA developing space instruments and writing software to analyze large amounts of scientific data using machine learning techniques.

- Luis Serrano– Luis was formerly a Machine Learning Engineer at Google.

- Cezanne Camacho– Cezanne is a machine learning educator with a Masters in Electrical Engineering from Stanford University.

- Mat Leonard– Mat is a former physicist, research neuroscientist, and data scientist.

Elizabeth Otto Hamel and Eddy Shyu explained most of the topics and I like their explanation. They explained the complex topics using a visual representation which helped me to understand the topics.

Arpan Chakraborty explained most of the NLP part. He also explained well.

Is Udacity Artificial Intelligence for Trading Nanodegree Worth It?/ Is AI for Trading Nanodegree Worth It?

Yes, the Udacity Artificial Intelligence for Trading Nanodegree is worth it for those who are planning to learn Artificial Intelligence for Trading and those who are already familiar with Python Programming, Statistics, linear algebra, and Calculus.

The whole Nanodegree program is combined with various Real-World projects that will make your understanding and resume powerful. You will also get One-to-One Mentorship to clear your doubts while working on projects.

Final Thought

I would recommend this Udacity Artificial Intelligence for Trading Nanodegree to those who are not beginners and have previous knowledge in Python Programming, statistics, linear algebra, and calculus.

Udacity will also provide some Free additional courses in the Naodegree program. These courses will cover the following topics- python basics, linear algebra, Jupyter Notebook basics, and statistics. You can learn the prerequisites from these elective courses.

Enroll-> Udacity Artificial Intelligence for Trading Nanodegree

Now it’s time to wrap up this Artificial Intelligence for Trading Udacity Review.

Conclusion

I hope this Artificial Intelligence for Trading Udacity Review helped you to decide whether to enroll in this program or not.

If you found this Artificial Intelligence for Trading Udacity Review/AI for Trading Review helpful, you can share it with others. And if you have any doubts or questions, feel free to ask me in the comment section.

All the Best!

Similar Searches

Udacity Artificial Intelligence Nanodegree Review- Latest 2025

Best Resources to Learn Natural Language Processing in 2025

8 Best Free Courses to Learn AI (Artificial Intelligence) in 2025

Best Certification Courses for Artificial Intelligence- Beginner to Advanced

Best Natural Language Processing Courses Online to Become Expert

Best Artificial Intelligence Courses for Healthcare You Should Know in 2025

What is Natural Language Processing? A Complete and Easy Guide

Best Books for Natural Language Processing You Should Read

Augmented Reality Vs Virtual Reality, Differences You Need To Know!

What are Artificial Intelligence Examples? Real-World Examples.

Thank YOU!

Explore more about Artificial Intelligence.

Though of the Day…

‘ It’s what you learn after you know it all that counts.’

– John Wooden

Written By Aqsa Zafar

Founder of MLTUT, Machine Learning Ph.D. scholar at Dayananda Sagar University. Research on social media depression detection. Create tutorials on ML and data science for diverse applications. Passionate about sharing knowledge through website and social media.